Market in a Range

The S&P 500 climbed almost 1% today to close at 2021.25 which was up 19.09. This occurred after an initial drop in the market before recovering in the last half of the day.

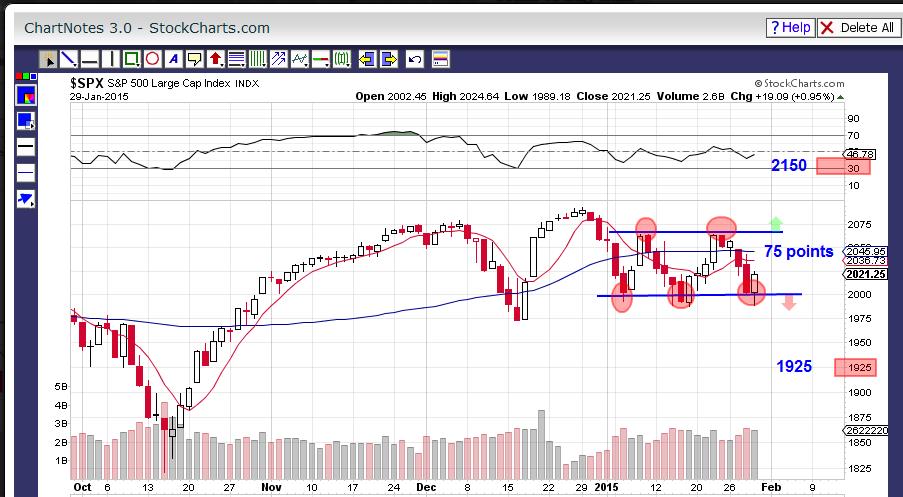

We can see from the chart below that the market has been trading in a range for the month of January. Today it tested the support around 2000 for the third time. The S&P touched around 2075 two separate times as a resistance.

Right now, we are looking at a potential triple bottom pattern forming which is bullish. However, we could also say, it looks like a double top pattern which is bearish. We need to see a confirmation before we can say which pattern we have. We need to break out of the trading range for the confirmation. A break below support would confirm the double top pattern. A break above resistance would confirm the triple bottom.

With a break out of the range, we can estimate the potential move of the S&P to be about 75 points, which is the approximate range it is trading in this month. A break in resistance would take the S&P to an expected level of about 2150. A break in support would take the S&P to an expected level of about 1925.

No comments yet.