Market Drop

Another big move occurred in the market today. We have one very bullish day (yesterday) sandwiched in between two very bearish days. The S&P closed down 40.68 today and the Dow closed down 334.97. The volatility is the concern here. Usually when the market climbs, it is more of a slower, steady climb. Any down days are small moves. When the market turns more bearish, the drops are big and quick. Increased volatility in the market causes concerns among traders. Increased volatility in a lot of instances precedes a bearish move.

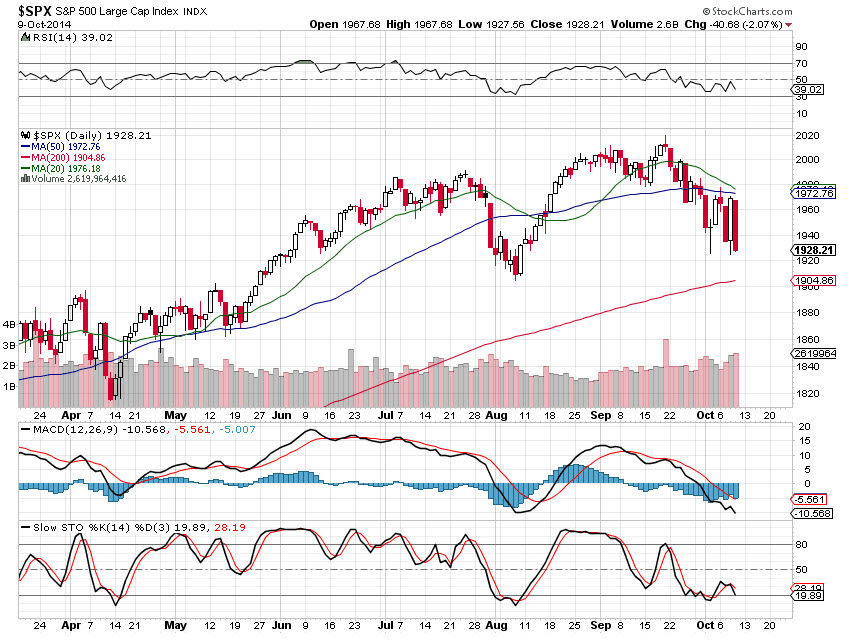

As you can see in the chart below, there are two key concerns on the chart. One would be a break below the early August low of 1904.78. Another concern would be a break below the 200 day moving average which currently is at 1904.86. The two concerns are at the same level. A move below hasn’t happened at this point. If the market were to drop and trade below about 1905, we could be in for an even more severe drop. That would be when we can start considering more bearish trades.

The market doesn’t look too bearish yet. It’s been resilient for the last few years after every concerning drop. It hasn’t failed to recover. It may be time to be cautious however. The reason for caution is the increase in the volatility. Tomorrow should be an interesting day.

No comments yet.